India’s e-commerce landscape is blazing a trail in 2025, cementing its status as a global powerhouse. On February 24, 2025, the latest updates spotlight a market driven by lightning-fast delivery, big-name expansions, and a manufacturing boom. Whether you’re a shopper, seller, or industry watcher, here’s why India’s online retail surge is the story to follow—and how it’s reshaping commerce worldwide.

The Speed Race: 10-Minute Delivery Takes Center Stage

Ultra-fast delivery is no longer a pipe dream—it’s India’s new reality. Leading the charge, Flipkart’s 10-minute delivery pilots are redefining quick commerce, catering to a young, urban crowd that demands instant gratification. Amazon India isn’t far behind, bolstering its logistics network to shrink delivery windows. According to Forbes India, quick commerce grew 30% in 2024 alone, and 2025 is poised to shatter records. This speed obsession isn’t just convenience—it’s a competitive edge in a market where every second counts. Search trends today show “10-minute delivery India” spiking, a sign that consumers are hooked.

Big Players Blend Online and Offline

Google’s rumored launch of physical stores in Delhi this month marks a seismic shift. A digital giant stepping into brick-and-mortar retail? It’s a nod to India’s unique blend of trust in physical touchpoints and love for online ease. Amazon’s been playing this game too, with export hubs that empower local sellers to go global. These moves signal a hybrid future—think of it as “phygital” commerce—where e-commerce giants use physical spaces to deepen their digital dominance. For India, it’s a winning formula.

Exports and Manufacturing: India’s Global Glow-Up

India’s e-commerce isn’t just about buying—it’s about creating and selling worldwide. Amazon India’s push to boost seller exports is turning artisans and small businesses into international names, shipping everything from sarees to smart gadgets. Add in the shift of iPhone component manufacturing to India, and you’ve got a dual-threat economy: a production hub feeding a retail juggernaut. This synergy could see India rival China as an e-commerce supply chain kingpin by decade’s end.

Challenges Fuel Innovation

Every boom has its bumps. Rising logistics costs, tied to the quick-commerce craze, are pinching profitability—Economic Times pegs fuel costs up 15% this year. Google Pay’s new convenience fees for certain transactions, trending on X today, might force retailers to rethink payment strategies. Plus, personalizing for India’s 1.4 billion people—across languages and cultures—is no small feat. Yet, these challenges are sparking ingenuity, from AI-driven logistics to regionalized storefronts.

Why India’s E-Commerce Boom Matters

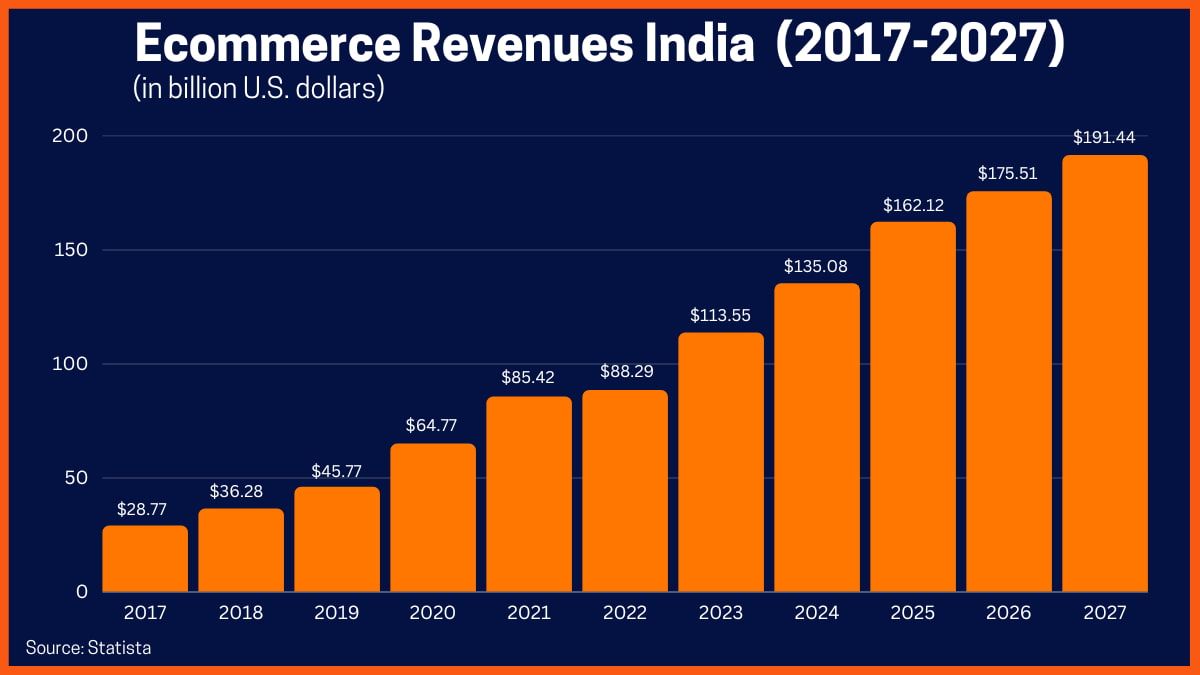

For shoppers, this means faster deliveries, richer choices, and a front-row seat to retail innovation. For sellers, it’s a launchpad to global markets, amplified by platforms like Amazon and Flipkart. Globally, India’s rise signals a shift—emerging economies can lead, not just follow. With Statista projecting India’s e-commerce market to hit $200 billion by 2027, the stakes—and rewards—are sky-high.

The Takeaway

India’s e-commerce revolution is more than a trend—it’s a transformation. From 10-minute deliveries to export empires, this market is setting the pace for 2025 and beyond. Want to dive deeper? Check out our guide to e-commerce trends (#) or explore how quick commerce is changing retail (#). India’s not just in the game—it’s rewriting the rules.